Trustlines is an excellent way to keep track of debts without the need to handle cash. For example, it is useful when splitting the bill at restaurants or for similar group activities. If you go out with your friends often, these payments will go back and forth for a long time. Using Trustlines helps create a friendlier environment for recording debts between friends, reducing the frequency of needing to settle with cash or bank money. It can even make settling wholly unnecessary.

One advantage of using Trustlines is that it also allows you to avoid handling cash even with people beyond your immediate circle of friends, by automatically moving around the credit in your network. For example, if your acquaintance Alice pays a restaurant $10 for your lunch, and your mutual friend Bob owes you $10, you can “pay” Alice back by simply transferring Bob’s debt to Alice. This transfer of credit occurs automatically during “multi-hop payments” on Trustlines.

Before you can use Trustlines for payments, you first need to create some trustlines with your trusted friends. You can create trustlines even with those you don’t plan to transact with often, increasing the extended network of people with whom you can transact. Higher credit limits on your trustlines will allow you to send larger payments. See the Trustlines App User Guide for instructions about opening trustlines.

Why use Trustlines for bill splitting

Traditional apps for bill splitting usually encourage quick settlement, often compelling users to connect a bank account or create an account with the service provider. These apps allow users to accumulate debt with friends, but they assume users will settle these debts directly via cash or bank transfer. They do not provide a general accounting system in which users can instead take advantage of credit clearing within the complete network of users, without necessarily settling in cash.

As money circulates in an economy, most debts should naturally cancel out over time. This is why it makes sense to use an accounting system like Trustlines for tracking debts, without the need for immediate settlement. An accounting system that clears credit automatically will reduce the frequency of needing to settle, and can even make settling wholly unnecessary. Furthermore, since Trustlines is highly secure, it does not require any intermediaries (like banks). Users can trust the ledger to keep good records, and do not need to connect an external bank account since no “real money” is transferred until users decide to settle.

In addition, unlike typical bill splitting apps, Trustlines can be used with people outside the user’s immediate circle of friends, or even with complete strangers. Strangers do not ordinarily trust each other with unsecured debt, so in most payment scenarios, people are obliged to use national currency. For example, most people rely on cash, bank cards, or traditional payment apps like PayPal or Venmo. But Trustlines allows users to avoid handling national currency and use credit instead, by rippling debts through friends-of-friends in the same currency network. This means you can use Trustlines to split the bill with people you don’t know very well, without worrying about getting your money back–since you will always end up holding credit directly with the people you trust. If you use Trustlines, you could potentially transact with credit in any scenario, and never have to connect a bank account.

The following section will provide some illustrative examples of how Trustlines may be used for bill splitting.

Example of splitting the groceries with roommates

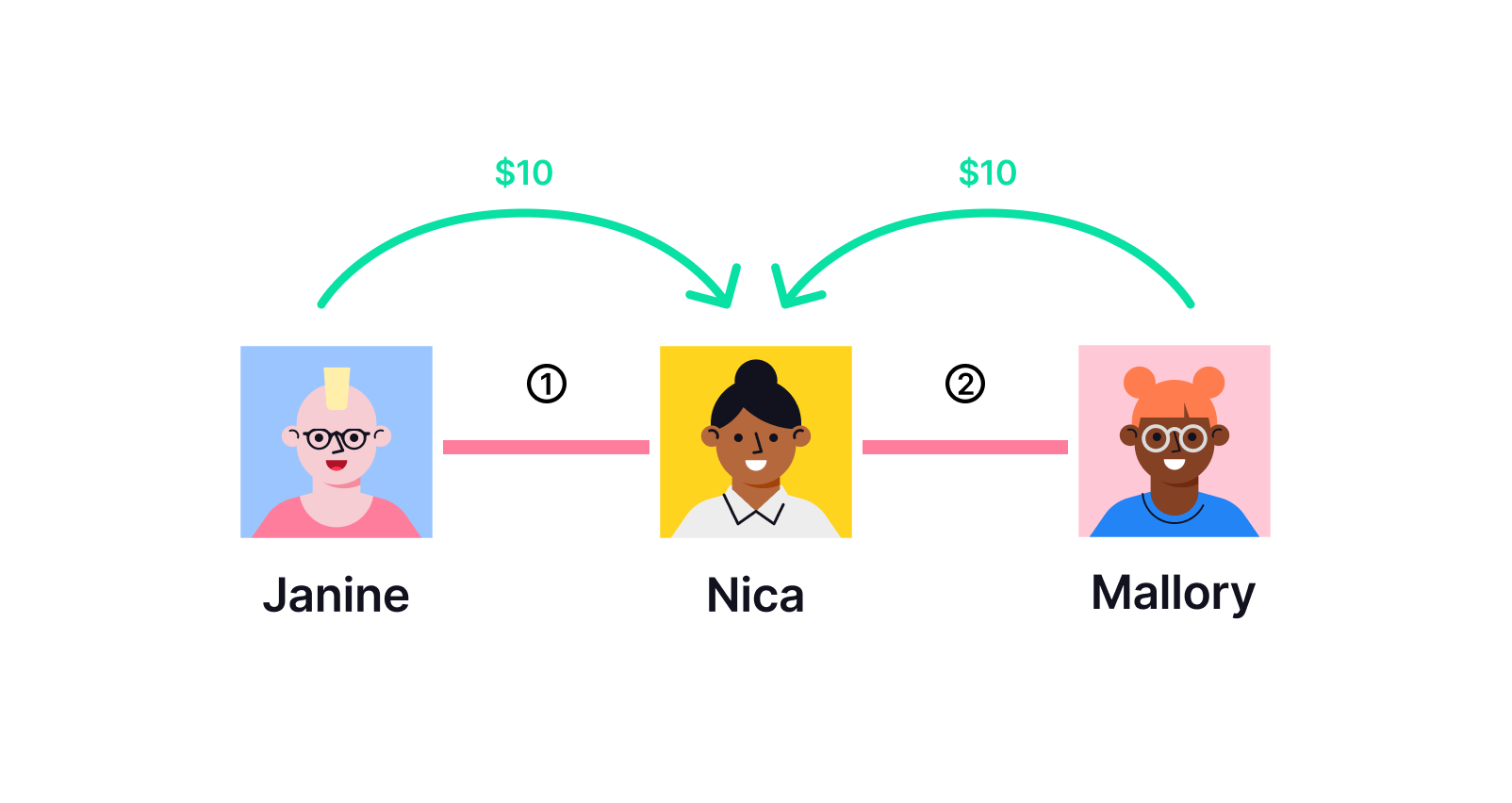

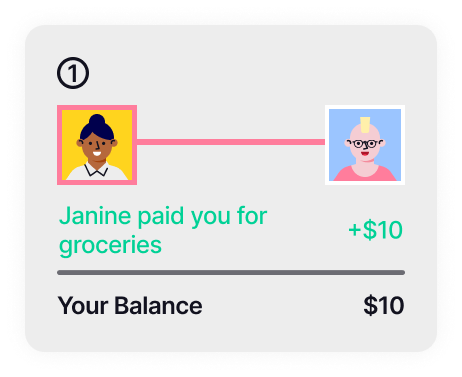

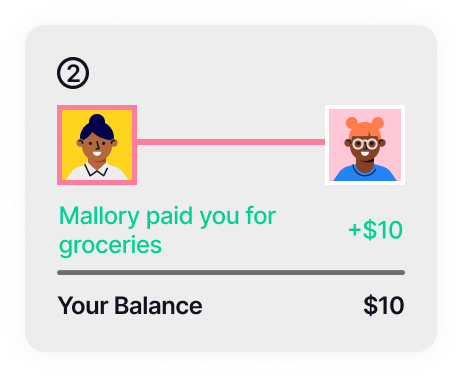

Today it’s Nica’s turn to go shopping for groceries to share with her roommates, Mallory and Janine. Both Mallory and Janine have trustlines with Nica. The groceries cost $30, and Nica pays this with her debit card. She will need to ask her roommates for $10 each in order to split the cost evenly.

It doesn’t make sense to demand cash from her roommates right now because Nica knows that next week they will do the grocery shopping, and she will have to pay them back. Instead, she decides to hold credit from each roommate. In other words, she’d like each roommate to make a promise that they owe her ten dollars.

To record these promises, she shares an electronic payment request for ten dollars with each of her roommates. She makes sure to add a note to the payment request explaining that it’s for this week’s groceries.

Soon after she sends these requests, each of her roommates receives a notification on their mobile phone. They each fulfill Nica’s payment request by sending credit for ten dollars, using Trustlines. None of them have to handle any cash during this process. If Nica checks her balances, she’ll notice that her balance with each roommate is $10. (If Mallory or Janine check their balances, they will each see it is -$10.)

More at the Trustlines Docs

This is just one example of how bill splitting can be done using Trustlines. At the Trustlines Docs, we have full documentation with more intricate examples.

Head on over to trustlines.app and start using the Trustlines App with your friends now! Let us know what you think about bill splitting using Trustlines at the Trustlines Forum!