There is clear potential for blockchain-based mutual credit systems in places like Venezuela. We are bringing People Powered Money to life. There is a definitive need for this in such places where the traditional financial system has failed. For People Powered Money, Venezuela is an excellent fit. The instability of the current financial system could well be balanced with the potential of a mutual credit system.

Venezuela’s Economic Crises

In the past decades, several hardships have affected Venezuela. There’s been political, social, and economic turmoil and unrest. One of the major factors has been that the use of foreign currencies has been almost entirely banned for the past twenty years.

Devaluation of the Venezuela national currency is a consequence of that decision to ban the use of foreign currencies. The national currency has gone through several changes from bolívar to bolívar fuerte to bolívar soberano. These new iterations have become known as the strong and sovereign bolívar, respectively, with digital bolívar being the most recent. A total of 14 zeros has been dropped from the currency in the last 14 years.

Such inflation and devaluation of the currency led to establishing a black market of foreign currencies. The US dollar began to dominate the market; soon, a ”dollarization” of the economy followed. While the majority of trades started to take place in USD, the individuals and businesses gained protection from the hyperinflation of the bolívar and facilitated more transactions.

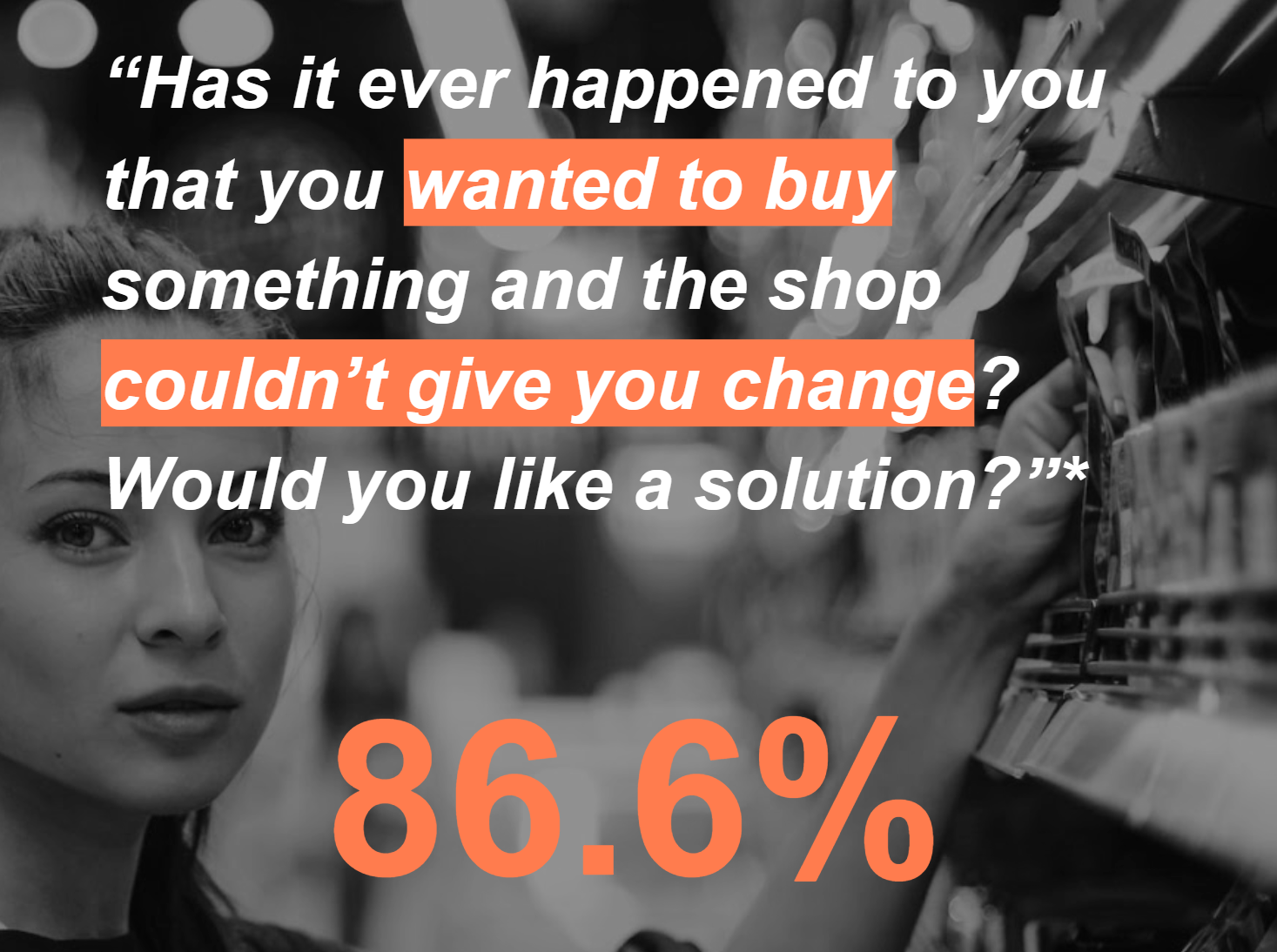

Due to the ban of foreign currencies, dollarization also brought some new challenges. What soon became apparent was the lack of a smaller denomination of bills. Larger denominations like the $20, $50, and even $100 bills would be common and easier to find, but that would not be true for the smaller bills. And this scarcity is especially true for coins, which are basically non-existent.

Without these smaller denomination bills and coins, it is almost impossible for the merchants and businesses to give back the exact change owed to the customer.

IOUs & Credit Economies

On their own initiative, some Venezuelans started to tackle this problem by issuing their own informal representations of the debt owed. IOUs, standing for ”I Owe You,” are a way to let the counterparty know that you are willing to honor debt to that person.

The informal IOUs began circulating in Venezuela as the customers were faced with the dilemma of either they spend an entire $20 bill on their purchase for a sale that would not fully utilize this value. Or they would have to make a choice not to purchase the items at all. The fact that the commerce side cannot give exact change gave rise to a real issue among Venezuelans.

This phenomenon of issuance of informal IOUs shows that a mutual credit system can indeed work in an economic climate that clouds Venezuela.

History also shows us that mutual credit systems are resilient in times of economic crisis. Wir Bank was established in 1934 in Switzerland. Their mutual credit system has seen its usage peak during times of high inflation and times of crisis. This also applies to other similar systems where they’ve found use, especially during the early 1990s and after the 2008 financial crisis.

But thus far, the informal IOU system in Venezuela has not been without problems in its current form. There is also some precedence in using IOUs by businesses, and it hasn’t always ended well. A major retailer started issuing their own versions to customers, only to be stopped by the government in their tracks.

Another problem is with handmade IOUs issued by smaller businesses and merchants. These can easily go missing or get worn out otherwise.

Research Findings

The Trustlines Foundation has funded a team in Venezuela to do research around this issue and then move on to offer them a solution.

The fantastic team on the ground did excellent work in their research phase. They did a study that showed that a digital, blockchain-based, mutual credit system is needed in Venezuela. And some questions also were raised by the people there, which is to be expected.

The study found that 63% of respondents stated that they were familiar with the concept of IOUs, and 57% said that they had accepted at least one IOU from a merchant in the past.

After witnessing the immense potential for mutual credit economies, a local business association reached out to the Trustlines Foundation. Together, we are now exploring how such a system could be used within their network.

Their goal was to create a type of credit money. One which could be used as a medium of exchange within their business association. And it has to be more secure than the handmade IOUs. They believe that such a credit economy would benefit thousands of customers and merchants in Venezuela.

Next Steps: Trade Exchange Pilot

Trustlines Foundation is now looking for a local business association to set up and pilot a Trade Exchange.

Trustlines Foundation and the local business association will work together to pilot the Trade Exchange in the coming months. The Foundation will provide business advice, technical support, and grant funding. The local business association will encourage their existing members to join the Trade Exchange and dedicate local staff to manage day-to-day operations. Once the pilot is beneficial to merchants and financially sustainable, the local business association to gradually take over all aspects of the Trade Exchange.

If you are a part of a local business association, co-working space, lending club, or other similar organization in Venezuela, please get in touch. We’d love to see how we can collaborate.

Get Involved

Learn more about Trustlines at https://trustlines.network/.

Get advice and support for your credit economy at https://trustlines.foundation/contact.

Apply for a grant from the Trustlines Foundation at https://trustlines.foundation/grants.